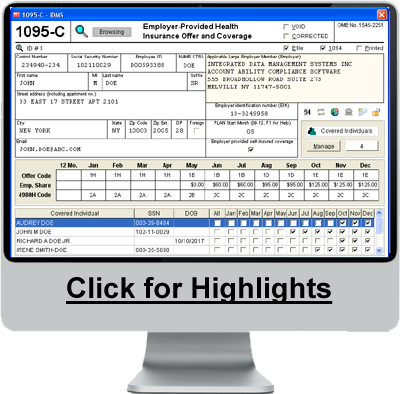

1095-C Software

The Affordable Care Act requires an Applicable Large Employer (ALE) to either offer health insurance coverage to its employees or pay a penalty. As part of that requirement, the law added §6056 to the Internal Revenue Code (IRC). IRC §6056 outlines what an ALE must do in order to notify both their workers and the IRS about the coverage the employer offers.

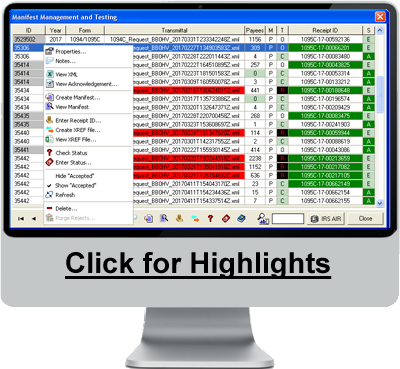

ALEs must report to the IRS information about the health care coverage, if any, they offered to full-time employees. The IRS uses this information to administer the employer shared responsibility provisions and the premium tax credit. IRC §6056 requires employers to send Form 1095-C at year's end to each employee who is eligible for employer-sponsored insurance, regardless of whether they actually participate in the employer's health plan. Form 1095-C informs the employee of which months out of the year he/she was eligible for coverage and how much the cheapest premiums available to him/her would have cost. ALEs must give the IRS transmittal Form 1094-C with copies of all 1095-C forms.

An ALE can furnish the employee with a copy of the Form 1095-C filed with the IRS or with an approved substitute form, which Account Ability prints using Item # 1095BCBLK50, available at the Account Ability Forms Division. The ACA Add-on for Account Ability complies with IRC §6056 and includes complete support for ACA Forms 1095-C and 1094-C.